Angel Investing and Crowdfunding: A Beginner’s Guide to Funding Startups

Angel investing is a popular way for individuals to support new businesses while making huge profits. It plays a crucial role in crowdfunding. As it helps startups get the money they need to grow. If you’re curious about investing in startups or wondering how platforms like Ollin.com can help, this guide will break everything down in simple terms.

What is Angel Investing?

Angel investing is when a person provides money to a startup in exchange for ownership (equity) or debt. Unlike banks, angel investors use their own money and often invest at an early stage when the business is still growing.

How Does Angel Investing Work?

Here’s a simple explanation on working of Angel Investing:

- Find a startup: Investors search for startups through networking, pitch events.

- Do research: Before investing, angels analyze the business plan, market potential, and risks.

- Invest money: If they believe in the idea, they provide funds in exchange for equity (ownership).

- Support the startup: Many angel investors also mentor and advise startups.

- Exit the investment: Investors make money when the startup grows and gets acquired or goes public.

- Follow up: Some investors reinvest their returns in new startups, expanding their portfolio.

- Build relationships: Angel investors often form strong connections with entrepreneurs, leading to future opportunities.

Angel Investing and Crowdfunding

Crowdfunding has changed the way startups raise money. Instead of relying only on banks or venture capitalists, businesses can now get funding from multiple investors.

There are different types of crowdfunding:

- Equity Crowdfunding: Investors get shares in the company.

- Reward-Based Crowdfunding: Investors receive a product or service instead of equity.

- Debt Crowdfunding: Startups borrow money and repay it with interest.

- Donation-Based Crowdfunding: People donate without expecting anything in return.

Angel investing is often mixed with equity crowdfunding. So, it allows investors to back startups in return for shares.

Why Angel Investing Fits Well with Crowdfunding?

- Crowdfunding platforms like Ollin.com make it simple for investors to discover new startups.

- Some crowdfunding platforms let investors start with as little as $100.

- Investors can see startup details and updates before investing.

- Startups can attract global investors, not just local backers.

- Businesses can raise capital quicker compared to traditional funding methods.

Why Should You Become an Angel Investor?

Angel investing has its risks, but it also comes with exciting opportunities. Here’s why people do it:

Pros of Angel Investing

- Successful startups can multiply an investor’s money many times over.

- Investors help create new businesses and jobs.

- Being an angel investor connects you with entrepreneurs and other investors.

- It’s a way to spread investment risk beyond stocks and real estate.

- Many investors enjoy helping startups succeed.

- Investors can get involved in promising companies before they become mainstream.

Risks of Angel Investing

- High Risk: Many startups fail, so there’s a chance of losing money.

- Long-Term Investment: It can take years before seeing a return on investment.

- Liquidity Issues: Unlike stocks, startup investments are not easy to sell quickly.

- Regulatory Risks: Changing laws can impact startup investments.

- Market Fluctuations: Economic downturns can affect startup success rates.

How to Start Angel Investing?

If you’re interested in angel investing but don’t know where to begin, follow these steps:

1. Educate Yourself

- Read books and articles about startup investing.

- Join angel investor networks or crowdfunding platforms.

- Attend startup pitch events and workshops.

2. Choose a Crowdfunding Platform

Platforms like Ollin.com make it easy to find promising startups. They provide details about the businesses, financials, and expected returns.

3. Start Small

- Invest only what you can afford to lose.

- Spread your investments across multiple startups.

- Learn from experienced investors before committing large sums.

4. Analyze Startups Before Investing

Look at these key factors:

| Factor | Why It Matters |

| Business Model | Is it scalable and profitable? |

| Market Potential | Is there demand for the product? |

| Founder Team | Are they experienced and dedicated? |

| Financials | Do they have a solid plan for growth? |

| Competition | Who are their rivals, and how do they stand out? |

| Customer Base | Do they have a loyal following? |

5. Monitor Your Investments

- Stay in touch with startup founders.

- Follow company updates and financial reports.

- Be ready to reinvest in promising businesses.

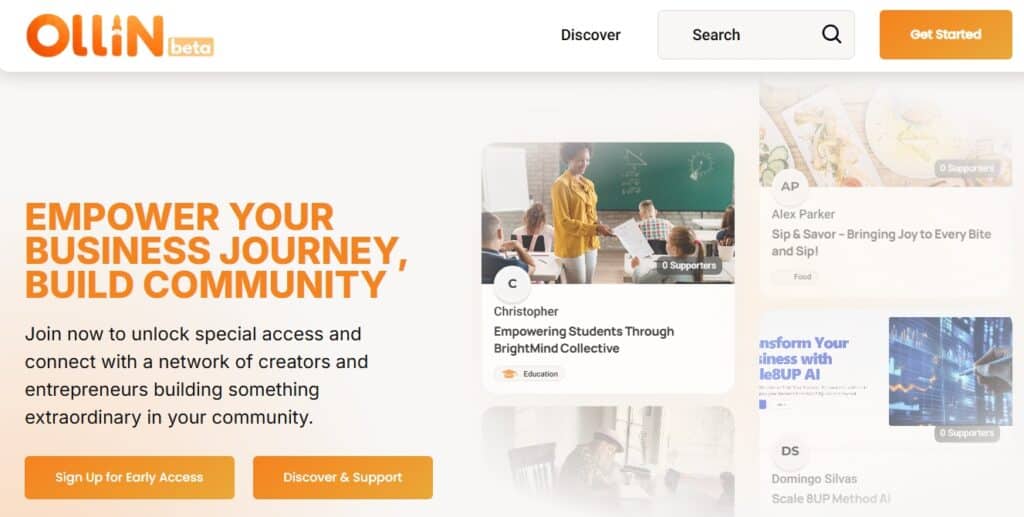

Ollin.com: A Leading Platform for Angel Investors

If you’re looking for an easy way to get started, Ollin.com is a top platform for angel investing and crowdfunding. It connects investors with startups, offering a secure and transparent process.

Why Choose Ollin.com?

- Verified Startups: Only promising businesses are listed.

- Investment Transparency: Get all the details before investing.

- Flexible Investment Options: Choose how much to invest based on your risk level.

- Investor Support: Access to mentorship and resources.

- User-Friendly Interface: Easy for beginners and experienced investors.

Future of Angel Investing

With the rise of AI, blockchain, and sustainable startups, angel investing is evolving. More investors are looking for tech startups, green businesses, and AI-driven solutions. Crowdfunding platforms are also making it easier for anyone to become an investor, increasing the number of angel investors worldwide.

Is Angel Investing Right for You?

Angel investing isn’t for everyone. It requires patience, research, and a willingness to take risks. However, if you:

✅ Enjoy supporting new businesses

✅ Have extra money to invest

✅ Want potential high returns

✅ Are willing to wait for long-term rewards

✅ Love learning about new industries … then angel investing might be a great fit for you!

Angel investing has become a popular way to support startups while earning potential profits. However, beyond the financial gains and risks, there’s a deeper side to angel investing that many don’t discuss. From understanding the psychology of startup founders to the unseen challenges investors face, this article explores fresh insights into the world of angel investing.

What Makes a Successful Angel Investor?

While having money to invest is essential, the best angel investors go beyond financial backing. They:

- Knowing which industries are booming helps investors choose startups with the highest potential.

- Connections with other investors, founders, and industry experts create better opportunities.

- Unlike stocks, startup investments take years to mature.

- A great idea isn’t enough. The startup’s success depends on the determination and skill of the founding team.

- Not all investments succeed, but learning from failed investments improves future decisions.

Angel Investing Beyond Just Money

Many assume angel investors only contribute money, but their role often extends far beyond that. They provide:

1. Industry Knowledge and Experience

Most startups lack experience in navigating business challenges. Angel investors with industry expertise can guide them through product development, marketing, and scaling challenges.

2. Valuable Connections

Startups often struggle to find suppliers, marketing experts, or future investors. Angel investors can introduce them to key people who accelerate their growth.

3. Emotional and Strategic Support

Launching a business is stressful. Angel investors who act as mentors provide emotional encouragement and strategic advice, increasing the likelihood of success.

Unique Risks That Angel Investors Face

Most investors know about the risk of losing money, but angel investing carries unique challenges that aren’t often discussed.

Startups often deal with regulatory uncertainties. Investors may unknowingly invest in a company that faces future legal troubles.

Not all founders take investor advice well. Conflict can arise when investors push for growth strategies that the founders disagree with.

Since angel investors often mentor startups, they may develop personal attachments, making it hard to exit the investment even when it’s necessary.

A startup that looked promising today may struggle tomorrow due to shifts in technology, consumer behavior, or government policies.

Angel Investing in Niche Markets

While many investors focus on tech startups, some niche industries offer exciting opportunities. Here are some lesser-known areas where angel investors are making a difference:

1. Sustainable Startups

Eco-friendly businesses are growing as consumers seek greener solutions. Investors looking to support sustainability can fund startups in renewable energy, biodegradable packaging, or electric mobility.

2. HealthTech Innovations

The healthcare industry is evolving with AI-powered diagnostics, personalized medicine, and telehealth solutions. Investing in health startups offers both financial and social impact opportunities.

3. EdTech Companies

Online learning platforms, AI tutoring apps, and skill-building courses are in high demand, making education technology a growing field for investment.

4. Gaming and Virtual Reality

The gaming industry is booming, with virtual and augmented reality offering new possibilities. Investors who understand gaming trends can spot profitable opportunities early.

Key Questions Every Angel Investor Should Ask Before Investing

Before committing to an investment, smart investors ask critical questions:

| Question | Why It Matters |

| What problem does the startup solve? | A great business solves a real issue, increasing its chances of success. |

| What is the founder’s long-term vision? | Founders with a clear roadmap can better execute their strategy. |

| What is the startup’s competition? | Knowing competitors helps assess market potential and challenges. |

| How will the startup use the investment? | Transparency about fund usage shows how wisely money will be spent. |

| What is the expected timeline for returns? | Angel investments take time, so setting realistic expectations is crucial. |

Angel Investing and the Psychology of Founders

A startup’s success depends heavily on the mindset and resilience of its founder. Investors should look for these key traits in a founder:

- Adaptability – The ability to pivot and adjust business strategies when needed.

- Resilience – Entrepreneurs face failures, but strong founders push through challenges.

- Leadership Skills – Leading a team and motivating employees is crucial for scaling a business.

- Communication – Founders should articulate their vision and maintain transparency with investors.

The Role of AI in Angel Investing

Technology is transforming how investors analyze and choose startups. Artificial Intelligence (AI) plays a key role in:

- Risk Assessment – AI-powered platforms analyze startup financials and market data to predict risks.

- Market Trend Prediction – AI tools identify industries and products with growing demand.

- Automated Due Diligence – AI speeds up legal and financial research, reducing the time needed for investment decisions.

Women in Angel Investing: A Growing Trend

Historically, angel investing has been dominated by men, but more women are now becoming investors. Female angel investors bring fresh perspectives and are more likely to support startups led by women, helping close the gender funding gap.

Reasons why more women are entering angel investing:

- Growing access to investor networks for women

- Increased focus on female-led startups

- Rising financial independence among women

- Desire to support innovation and mentorship

The Future of Angel Investing

With rapid advancements in technology and changing investment trends, here’s what’s next for angel investing:

- Platforms like Ollin.com will continue to make startup investing more accessible to small investors.

- Smart contracts and blockchain technology will enhance investment security.

- Investors will prioritize businesses that generate profit while positively impacting society.

- Smaller investment amounts will enable more people to participate in angel investing.

For those looking to start their journey in angel investing, staying informed, networking with other investors, and using platforms like Ollin.com can provide the tools needed to make smart investment choices.

Whether you’re an experienced investor or just getting started, understanding the broader landscape of angel investing will help you make more informed and successful decisions.

Hobby Airport to Galveston Shuttle provides seamless transportation with private, shared, or luxury black car services. Whether traveling to a cruise terminal or hotel, book the most reliable Houston to Galveston Shuttle for a hassle-free experience.

For affordable and reliable airport transportation, Airport Taxi London Ontario is your go-to choice. From London to Toronto Pearson transfers to executive taxi options, we provide stress-free travel solutions. Book London Ontario Airport Taxi or Toronto Pearson Airport shuttle services today and enjoy exceptional service from start to finish.

Usually I do not read article on blogs however I would like to say that this writeup very compelled me to take a look at and do it Your writing style has been amazed me Thank you very nice article

[url=https://slots-casino-com.ru]slots-casino-com.ru[/url]

Здравствуйте, уважаемые участники форума! ??

Если вас интересует, как играть в Slot Casino Com через телефон, перейдите по ссылке ниже. Там вы найдете подробную инструкцию, которая поможет вам быстро и легко освоить игру. Удачи и приятного времяпрепровождения! ??

slots-casino-com.ru

Interesting read! The focus on seamless tech – like instant verification – at 888phl really highlights a shift in online gaming. Reducing friction is key to player experience, and milliseconds do matter! It’s about more than just games now.

Scratch cards are such a fun, quick thrill! I recently discovered 999phl casino and the fast payouts are a game changer – seriously! Easy sign-up with GCash too, which is a huge plus for a quick gaming break. 👍

It’s fascinating how gaming platforms now deeply cater to cultural preferences – like 68wim’s focus on Vietnamese players. Seamless logins & localized support are key! Check out the 68win app for a tailored experience – understanding those player motivations is huge.

It’s fascinating how easily we fall into patterns when gaming – chasing losses is a classic! Seeing platforms like bossjl casino offer quick registration & diverse games (like those slots!) could add to that, so mindful play is key. 🤔

I’ve tried several platforms, but Super PH stands out for its smooth gameplay and great bonuses. Their live dealer games feel authentic, and the support team is always quick to help when needed. A solid pick for serious players.

Dice games are all about understanding probability – even seemingly simple ones! It’s cool how JL Boss (check out the jl boss app) makes things easy & fun, like a playful jungle for beginners. A simple signup is key, just like learning the rules! 😊

Scratch cards are such a fun, quick thrill! It’s cool seeing platforms like jljl555 app download apk offer so many gaming options beyond just the classics – slots, live casinos, everything! Makes it easy to find something new. 😄

Interesting read! The focus on a secure, transparent gaming ecosystem-like with 789pet app download apk-is a smart move. Building trust is key, especially with online platforms & KYC processes. Great points about user experience too!

Interesting read! The focus on data-driven gaming at platforms like j8ph online casino really changes the experience. KYC is a must for legit sites, and streamlined access (like that app!) is key for players. 👍

Smart bankroll management is key, even with exciting platforms like 77ph game. Seeing easy registration & local payment options (like GCash!) is a plus, but remember responsible gaming always comes first! It’s about fun, not fortune.

Interesting read! Statistical fairness in online gaming is key, and platforms like Phlwim seem to prioritize that. Checking for a phlwim games legit experience is smart – KYC is crucial for secure withdrawals, right? Good insights here!

RTP analysis is key when choosing online casinos! Transparency like jljl77 legit slot download builds trust – crucial for a good experience. KYC processes are standard, but a smooth signup is a plus! 👍

0jgr80

[url=https://detikoptevo.ru/]Шары на день рождения[/url]: они вызывают улыбку, восторг и делают любое торжество незабываемым. Вы можете купить как готовые композиции, так и отдельные шары для декора — быстро, удобно и по доступной цене.

Вы можете выбрать шары с надписями, цифрами, именами или просто любимыми цветами. Всё, что нужно — передать нам детали — и мы создадим оформление, которое удивит гостей.

Шары помогают сделать праздник личным, атмосферным и по-настоящему запоминающимся.

Сделайте заказ прямо сейчас — и создайте настроение, которое останется в памяти.

https://detikoptevo.ru/

Я не из тех, кто верит в «быстрые деньги», но тут сам убедился: когда подходишь с умом, можно не только развлечься, но и заработать. А всё началось с https://vodka-registration.site — платформы, где слоты реально отдают. Играешь без задержек, интерфейс не лагает, а выплаты — чётко по расписанию. Особенно понравилась функция избранных игр: выбрал, сохранил и больше не тратишь время на поиск. Турниры — отдельный кайф. Можно не только посоревноваться, но и поднять неплохую сумму. А ещё тут нормальный подход к промокодам — они приходят не «на авось», а под реальные активности. Видно, что разработчики не просто копируют других, а вкладываются в идею. Играешь не потому, что больше нечего делать, а потому что действительно интересно.

I couldn’t resist commenting

real online pokies in united states, united statesn casino online and casino deposit bonus usa, or are there casinos

illegal gambling in india (Antony) usa

Its like you read my mind! You appear to understand a lot about this, like you wrote the book in it or something. I believe that you simply could do with some percent to drive the message home a bit, but other than that, that is excellent blog. An excellent read. I will definitely be back.

Appreciating the commitment you put into your site and in depth information you provide. It’s awesome to come across a blog every once in a while that isn’t the same unwanted rehashed material. Wonderful read! I’ve bookmarked your site and I’m including your RSS feeds to my Google account.

**mind vault**

mind vault is a premium cognitive support formula created for adults 45+. It’s thoughtfully designed to help maintain clear thinking

**mind vault**

mind vault is a premium cognitive support formula created for adults 45+. It’s thoughtfully designed to help maintain clear thinking

**gl pro**

gl pro is a natural dietary supplement designed to promote balanced blood sugar levels and curb sugar cravings.

**sugarmute**

sugarmute is a science-guided nutritional supplement created to help maintain balanced blood sugar while supporting steady energy and mental clarity.

**vittaburn**

vittaburn is a liquid dietary supplement formulated to support healthy weight reduction by increasing metabolic rate, reducing hunger, and promoting fat loss.

**synaptigen**

synaptigen is a next-generation brain support supplement that blends natural nootropics, adaptogens

**glucore**

glucore is a nutritional supplement that is given to patients daily to assist in maintaining healthy blood sugar and metabolic rates.

**prodentim**

prodentim an advanced probiotic formulation designed to support exceptional oral hygiene while fortifying teeth and gums.

**nitric boost**

nitric boost is a dietary formula crafted to enhance vitality and promote overall well-being.

**sleep lean**

sleeplean is a US-trusted, naturally focused nighttime support formula that helps your body burn fat while you rest.

**wildgut**

wildgutis a precision-crafted nutritional blend designed to nurture your dog’s digestive tract.

**mitolyn**

mitolyn a nature-inspired supplement crafted to elevate metabolic activity and support sustainable weight management.

**yusleep**

yusleep is a gentle, nano-enhanced nightly blend designed to help you drift off quickly, stay asleep longer, and wake feeling clear.

**zencortex**

zencortex contains only the natural ingredients that are effective in supporting incredible hearing naturally.

**breathe**

breathe is a plant-powered tincture crafted to promote lung performance and enhance your breathing quality.

**prostadine**

prostadine is a next-generation prostate support formula designed to help maintain, restore, and enhance optimal male prostate performance.

**pinealxt**

pinealxt is a revolutionary supplement that promotes proper pineal gland function and energy levels to support healthy body function.

**energeia**

energeia is the first and only recipe that targets the root cause of stubborn belly fat and Deadly visceral fat.

**prostabliss**

prostabliss is a carefully developed dietary formula aimed at nurturing prostate vitality and improving urinary comfort.

**boostaro**

boostaro is a specially crafted dietary supplement for men who want to elevate their overall health and vitality.

**potentstream**

potentstream is engineered to promote prostate well-being by counteracting the residue that can build up from hard-water minerals within the urinary tract.

**hepato burn**

hepato burn is a premium nutritional formula designed to enhance liver function, boost metabolism, and support natural fat breakdown.

**hepatoburn**

hepatoburn is a potent, plant-based formula created to promote optimal liver performance and naturally stimulate fat-burning mechanisms.

**flow force max**

flow force max delivers a forward-thinking, plant-focused way to support prostate health—while also helping maintain everyday energy, libido, and overall vitality.

**neurogenica**

neurogenica is a dietary supplement formulated to support nerve health and ease discomfort associated with neuropathy.

**cellufend**

cellufend is a natural supplement developed to support balanced blood sugar levels through a blend of botanical extracts and essential nutrients.

**prodentim**

prodentim is a forward-thinking oral wellness blend crafted to nurture and maintain a balanced mouth microbiome.

**revitag**

revitag is a daily skin-support formula created to promote a healthy complexion and visibly diminish the appearance of skin tags.

**memorylift**

memorylift is an innovative dietary formula designed to naturally nurture brain wellness and sharpen cognitive performance.

My Profile – Amazing depth and accuracy. You clearly know your stuff.

Follow my blog – You made a complicated idea sound effortless.

Visit my Blog – This deserves more comments. Such a solid post!